In venture capital, due diligence separates the winners from the losers. Yet traditional due diligence is painfully slow: weeks of manual research, spreadsheet modeling, and report writing. What if you could compress that into hours while maintaining institutional-grade rigor?

That's exactly what K-Dense Web delivers. In this post, we'll walk through two real case studies: CoreWeave (a $19B+ GPU infrastructure company) and Ramp (a $32B fintech platform). Both analyses were completed end-to-end by K-Dense Web, producing comprehensive investment memos ready for IC review.

The Due Diligence Challenge

Investment committees need answers to critical questions:

- Market sizing: How big is the opportunity? What's the TAM/SAM/SOM trajectory?

- Unit economics: Do the numbers work? What are the margins and payback periods?

- Competitive positioning: What's the moat? How defensible is the business?

- Risk assessment: What could go wrong? How do we stress-test the thesis?

Traditional approaches require analysts to manually:

- Research market data across dozens of sources

- Build financial models from scratch

- Create competitive analyses and risk matrices

- Write lengthy investment memos

- Design visualizations for IC presentations

K-Dense Web automates this entire workflow.

Case Study 1: CoreWeave Due Diligence

Company: CoreWeave, Inc.

Sector: GPU-as-a-Service / AI Infrastructure

Valuation: $19B+ (January 2026)

The Analysis Request

A single prompt to K-Dense Web:

"Conduct comprehensive VC due diligence on CoreWeave. Include market sizing, unit economics modeling, competitive analysis, and risk assessment. Generate an investment memo with recommendation."

What K-Dense Web Delivered

K-Dense Web executed a four-step analysis workflow:

- Market Sizing & Competitive Analysis: TAM/SAM/SOM projections (2024-2030), competitive pricing comparison across 7 providers

- Unit Economics Modeling: Per-GPU financial model with 88 utilization scenarios

- Risk & Supply Chain Analysis: Quantitative risk matrix, customer concentration analysis, Porter's Five Forces

- Final Visualization & Reporting: Executive dashboard, investment memo, recommendation synthesis

Total execution time: < 2 hrs.

Key Findings: The Investment Thesis

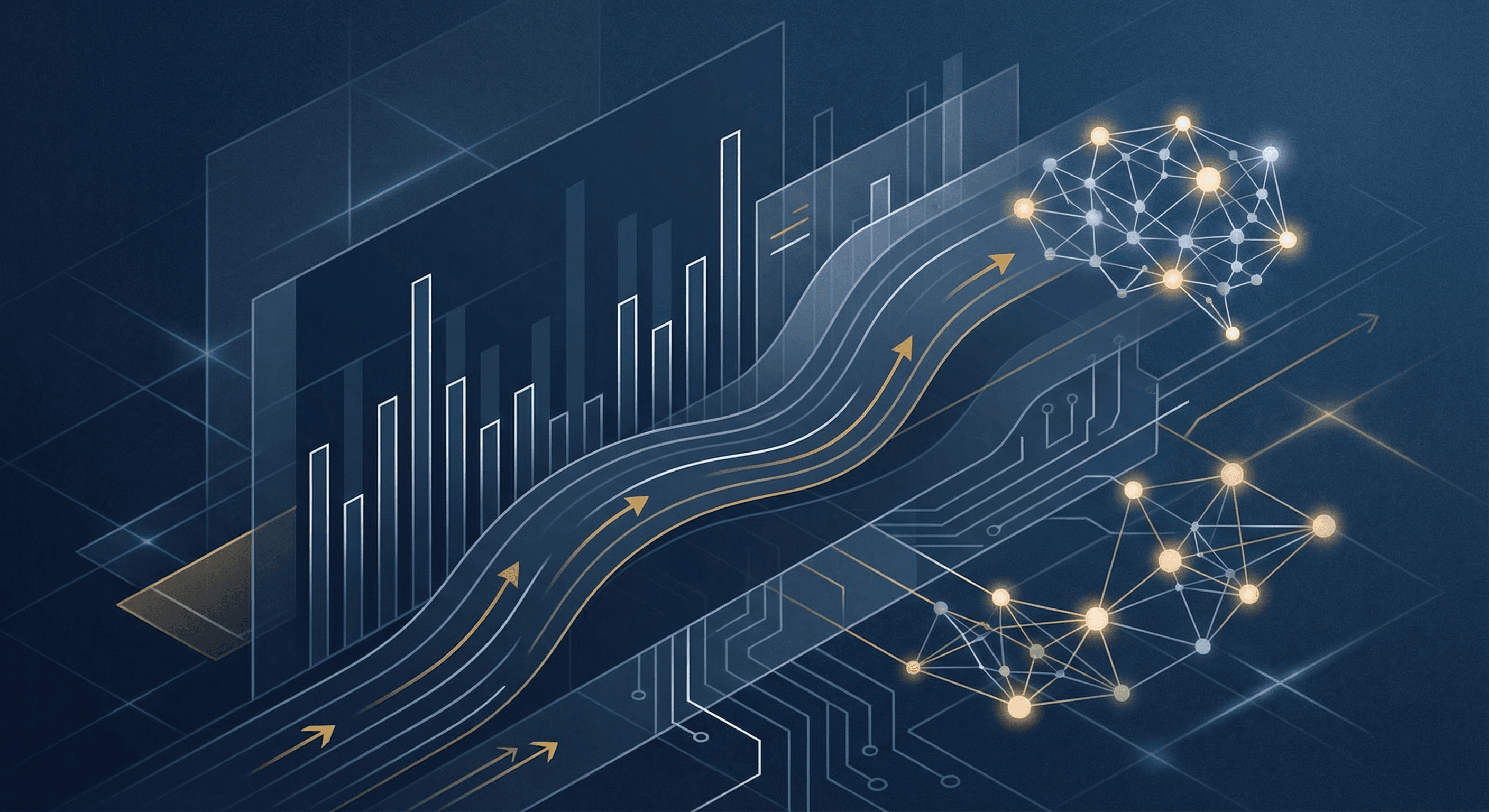

Figure 1: CoreWeave investment thesis overview generated by K-Dense Web

Figure 1: CoreWeave investment thesis overview generated by K-Dense Web

K-Dense Web identified a CONDITIONAL GO recommendation with the following key metrics:

| Metric | Value | Assessment |

|---|---|---|

| TAM CAGR (2024-2030) | 33.4% | Strong market tailwind |

| Gross Margin | 74-80% | Excellent unit economics |

| Cash Payback | 42-59 months | Within asset life |

| Critical Risks | 1 (NVIDIA dependency) | Requires mitigation |

| Expected Return | 2-3x (probability-weighted) | Attractive |

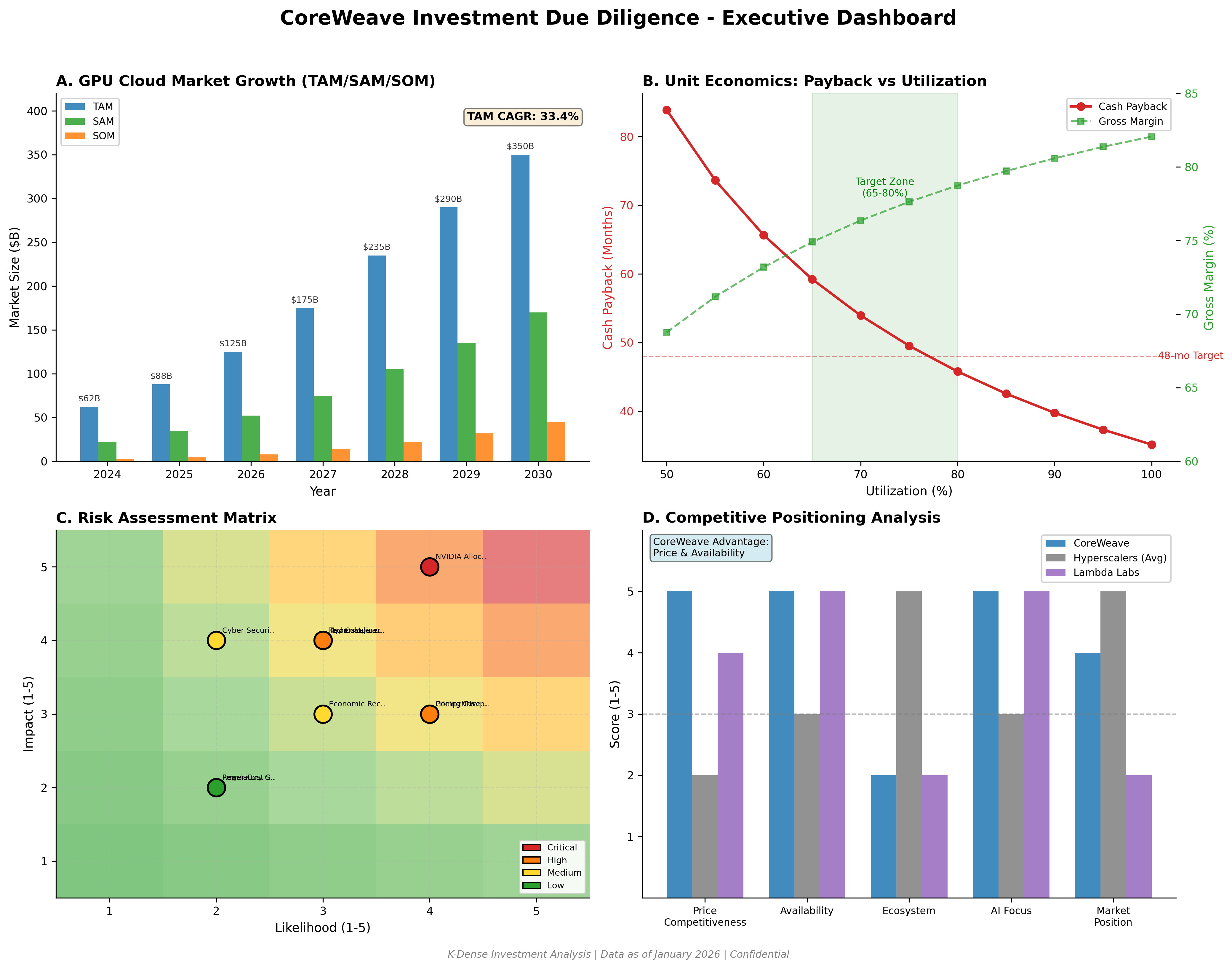

Market Opportunity Analysis

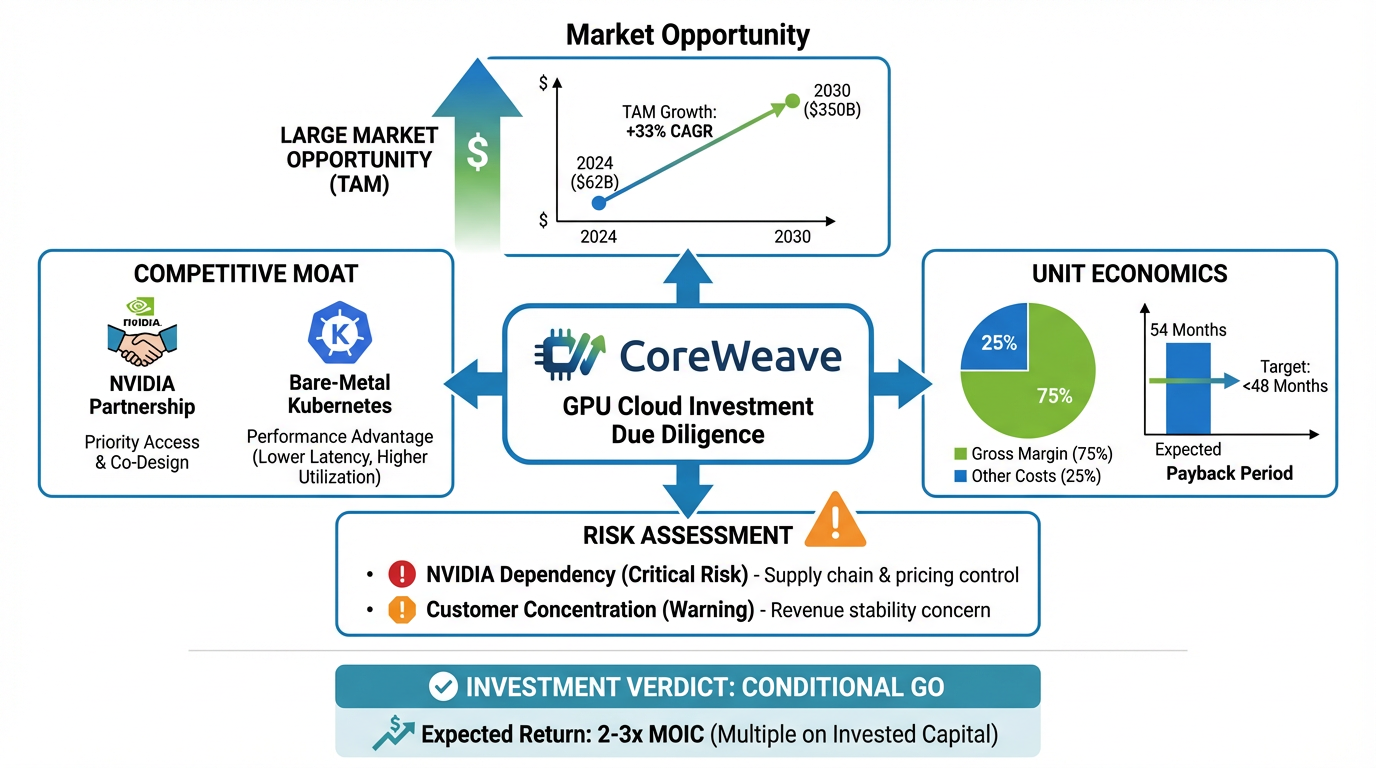

The platform modeled the AI infrastructure market growing from $62B (2024) to $350B (2030):

Figure 2: TAM/SAM/SOM market sizing funnel with 6-year projections

Figure 2: TAM/SAM/SOM market sizing funnel with 6-year projections

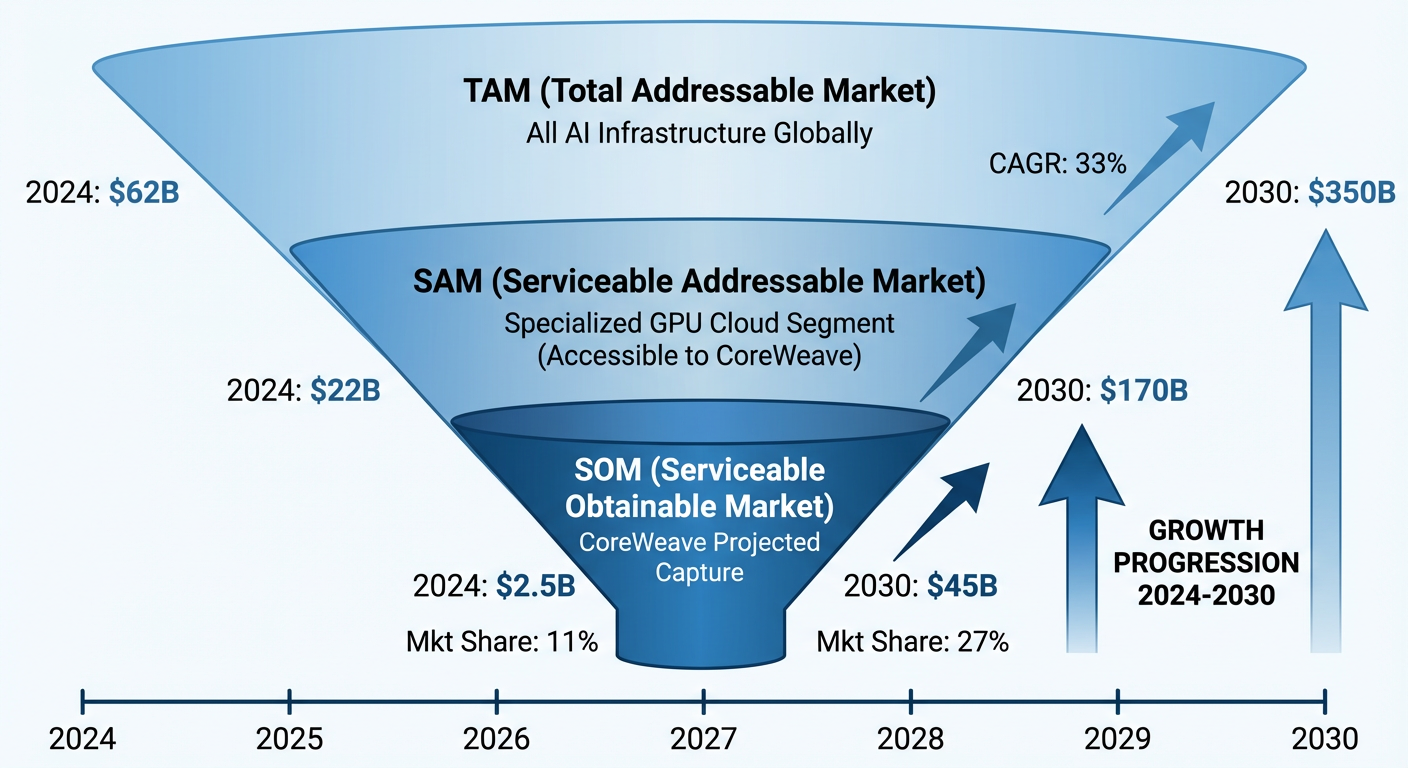

Competitive Positioning

K-Dense Web benchmarked CoreWeave against hyperscalers and specialized providers:

Figure 3: Competitive positioning analysis - CoreWeave vs. hyperscalers and specialists

Figure 3: Competitive positioning analysis - CoreWeave vs. hyperscalers and specialists

Key finding: CoreWeave maintains a 35-83% pricing advantage below AWS, Azure, and GCP while offering specialized GPU infrastructure.

Unit Economics Deep Dive

The financial model analyzed per-GPU economics across 88 scenarios:

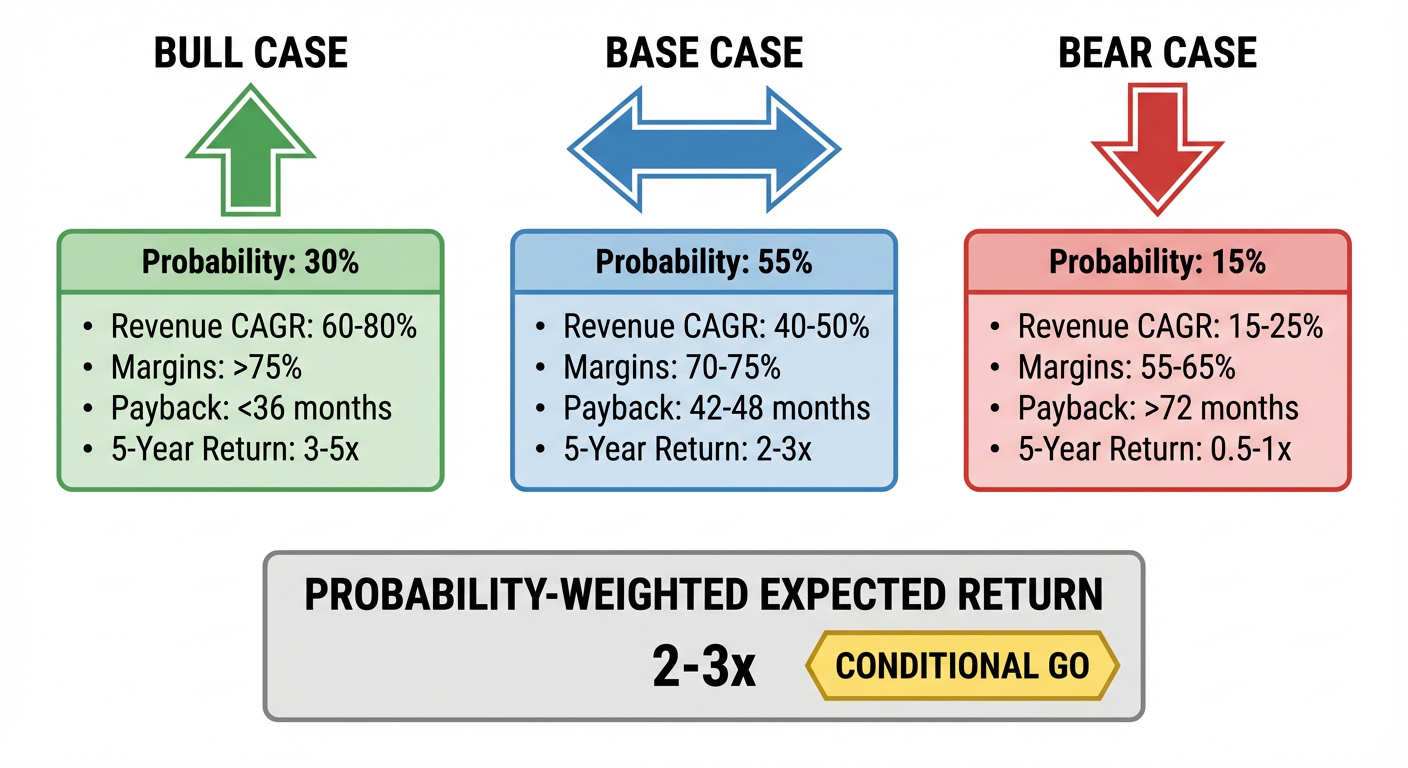

Figure 4: Probability-weighted investment scenarios (Bull/Base/Bear)

Figure 4: Probability-weighted investment scenarios (Bull/Base/Bear)

| Utilization | Gross Margin | Cash Payback |

|---|---|---|

| 65% | 74.9% | 59.2 months |

| 70% | 76.4% | 53.9 months |

| 85% | 79.7% | 42.6 months |

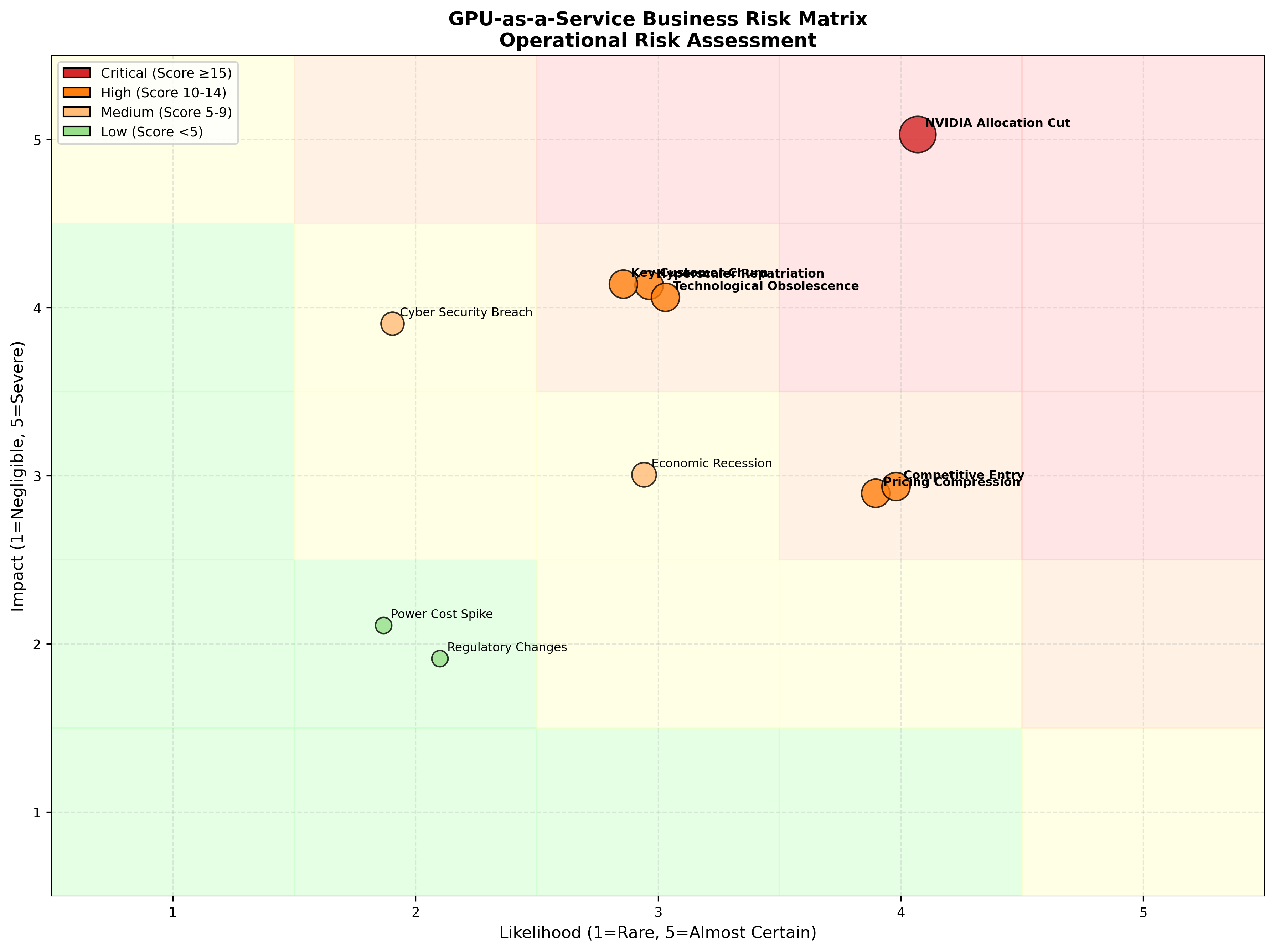

Risk Assessment

K-Dense Web identified NVIDIA allocation as the single critical risk:

Figure 5: Quantitative risk matrix with 10 identified risks

Figure 5: Quantitative risk matrix with 10 identified risks

Critical risk (Score 20/25): NVIDIA controls GPU allocation. Supply constraints could limit CoreWeave's growth capacity.

The Executive Dashboard

Every K-Dense Web due diligence package includes a consolidated executive dashboard:

Figure 6: Four-panel executive dashboard for IC presentation

Figure 6: Four-panel executive dashboard for IC presentation

Download the Full Report

Download CoreWeave Due Diligence Report (PDF)

Case Study 2: Ramp Due Diligence

Company: Ramp Technologies, Inc.

Sector: Corporate Card & Spend Management

Valuation: $32B (November 2025)

The Analysis Request

"Conduct comprehensive VC due diligence on Ramp. Analyze market sizing, competitive positioning, unit economics, and risks. Generate an investment memo with valuation scenarios."

What K-Dense Web Delivered

A complete 44-page investment analysis including:

- Executive summary with investment recommendation

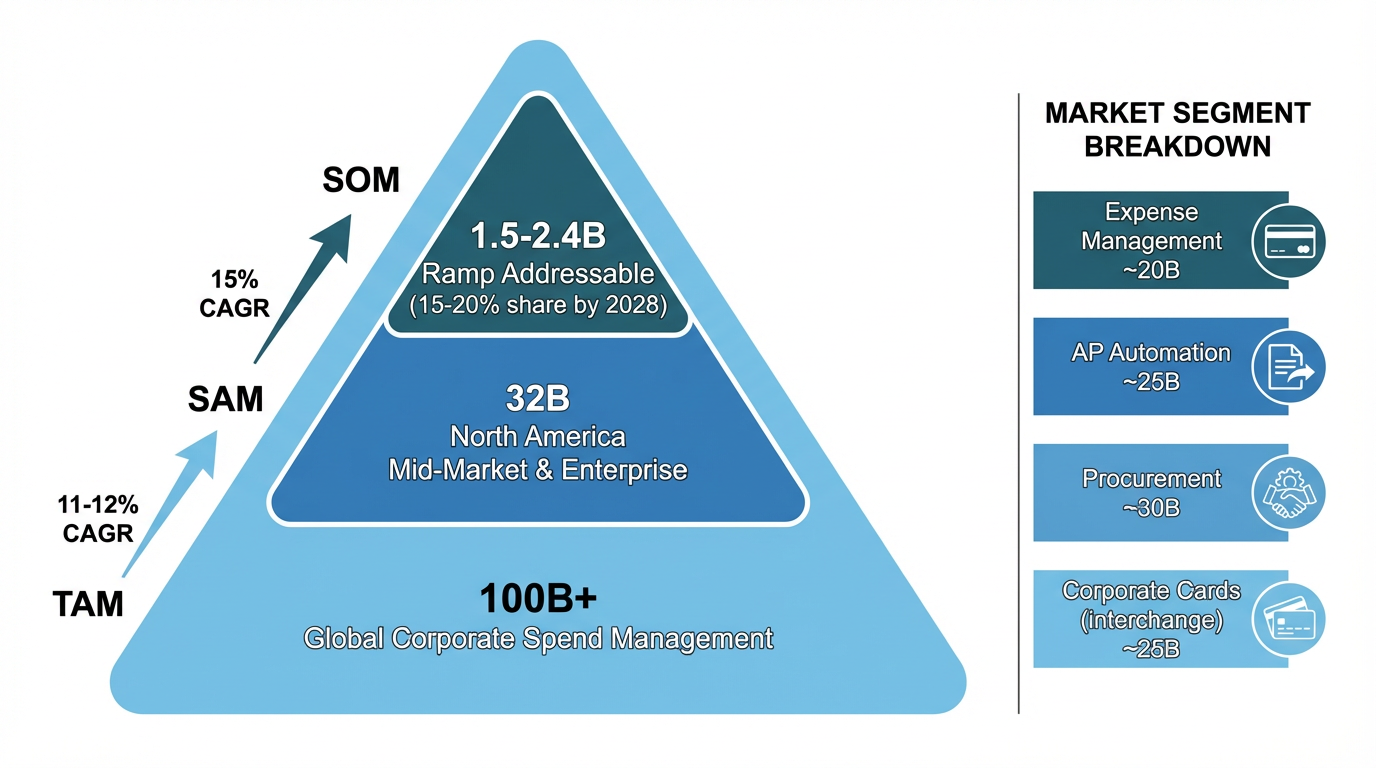

- TAM/SAM/SOM analysis ($50B+ market)

- Competitive benchmarking against Brex, Bill.com, Airbase

- Unit economics deep dive (interchange, SaaS, float revenue)

- IPO readiness scorecard

Total execution time: < 2 hrs.

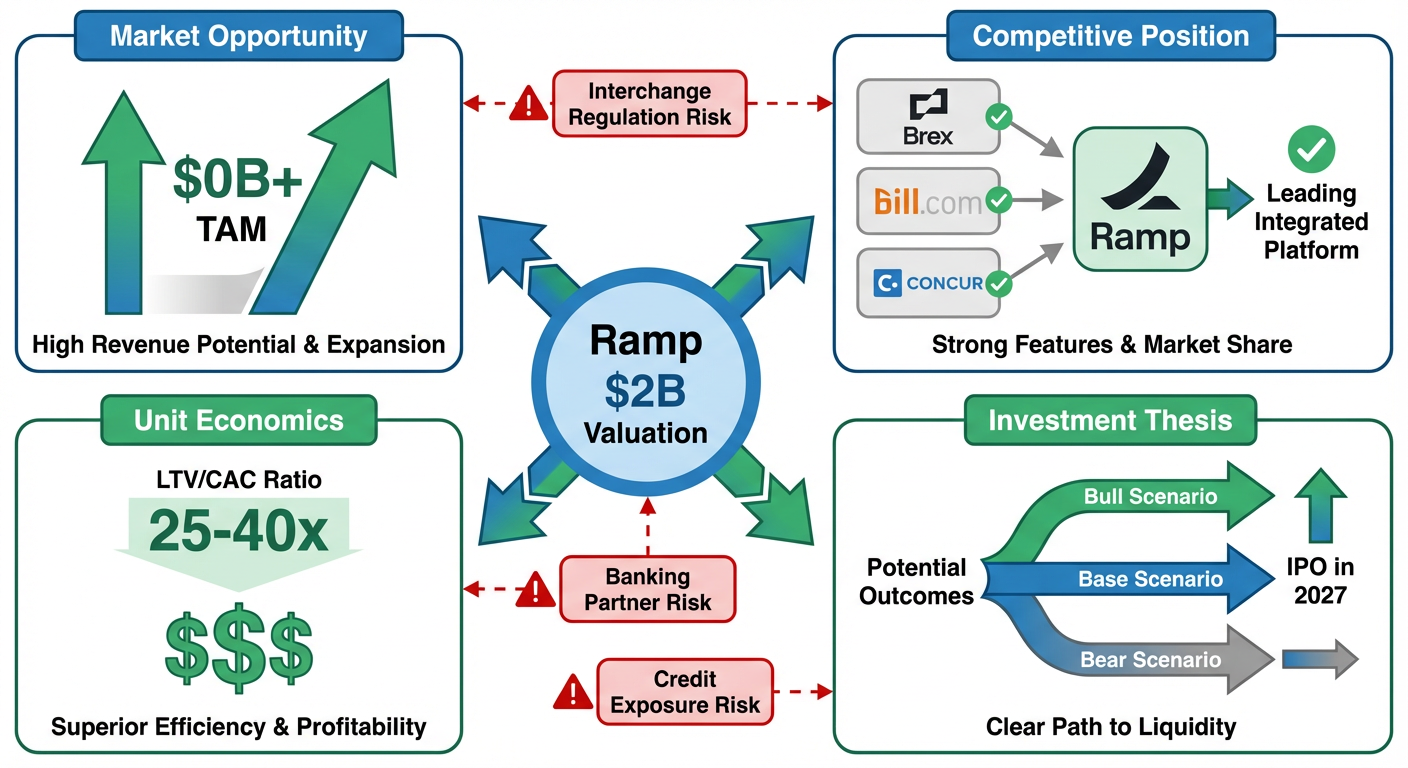

Key Findings: Strong Buy Recommendation

Figure 7: Ramp investment thesis - AI-first spend management platform

Figure 7: Ramp investment thesis - AI-first spend management platform

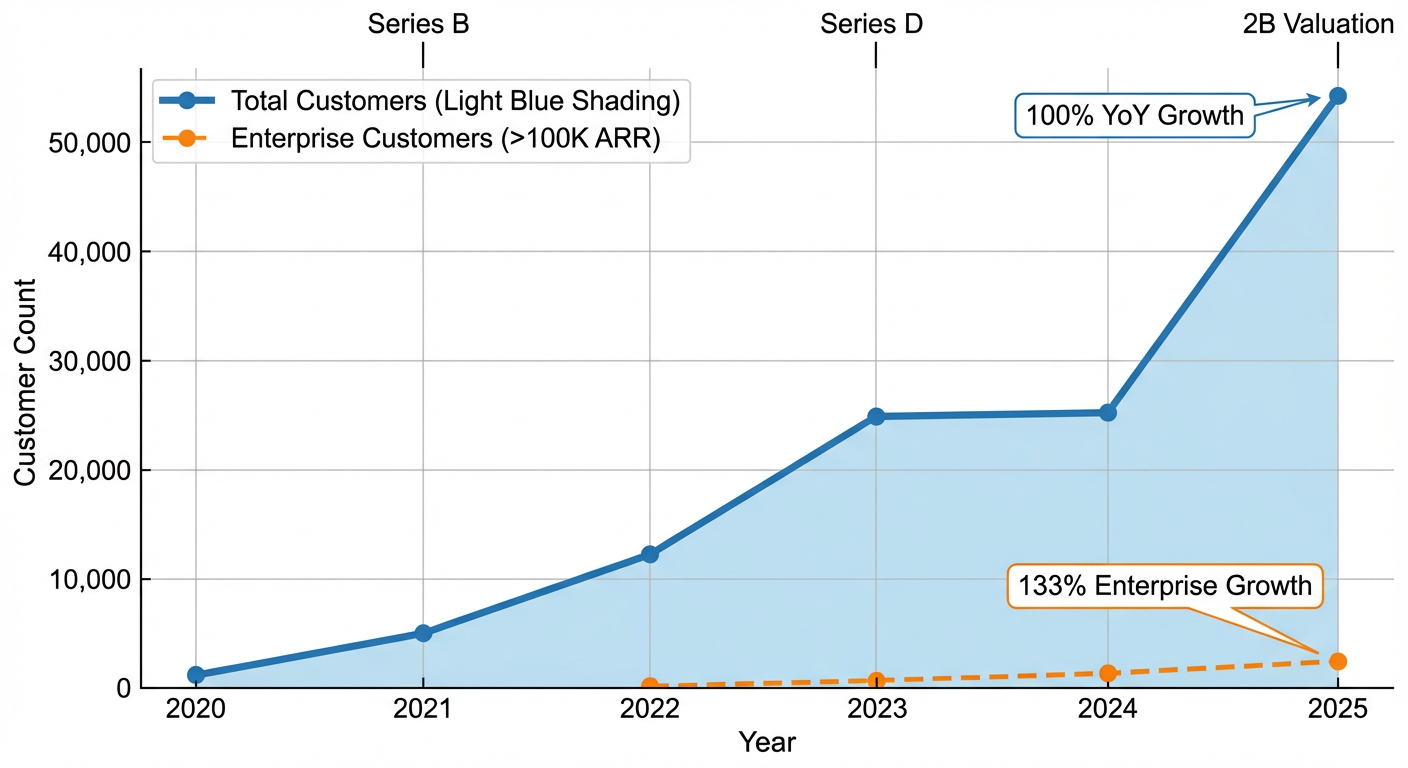

K-Dense Web delivered a STRONG BUY recommendation:

| Metric | Value |

|---|---|

| Revenue | >$1B annualized |

| Growth Rate | 110-133% YoY |

| Total Payments Volume | >$100B annually |

| Customers | 50,000+ (doubled YoY) |

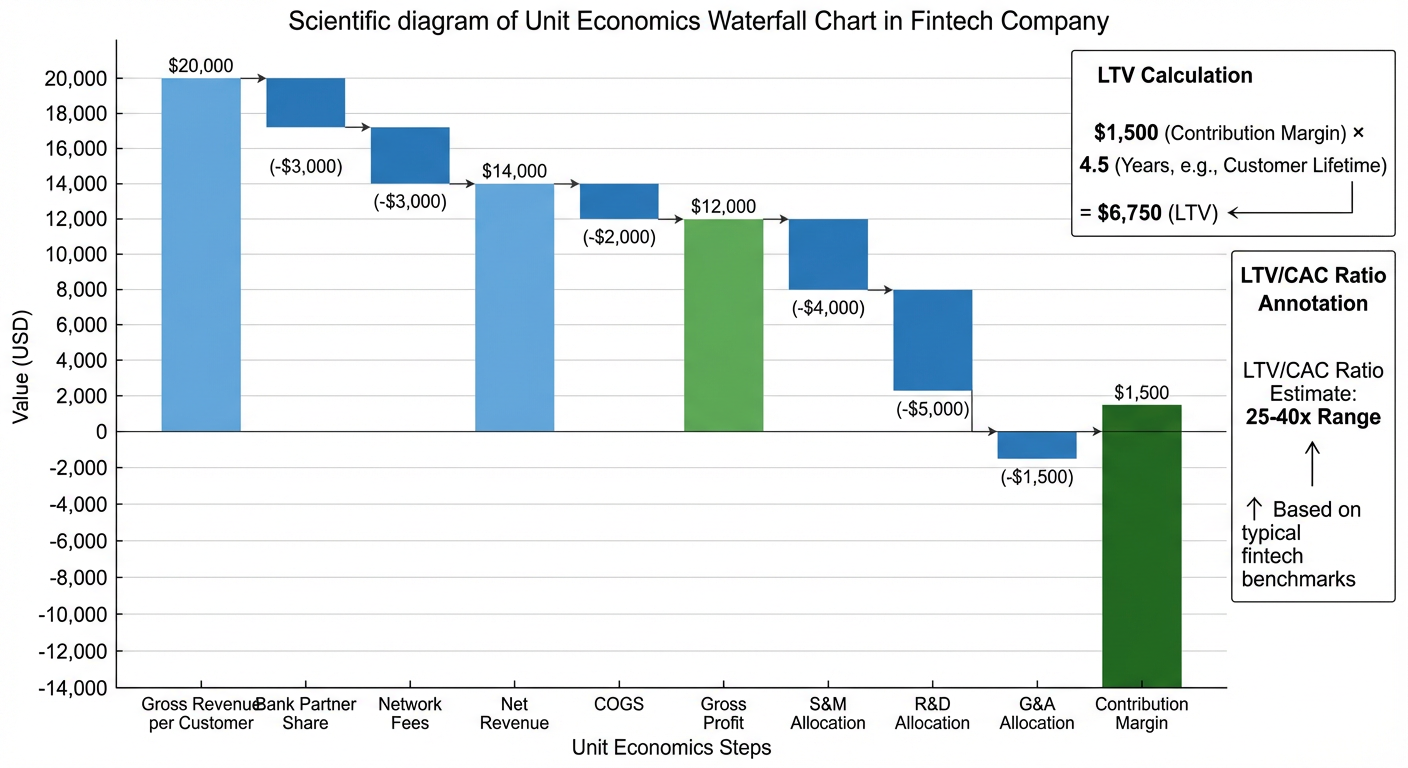

| LTV/CAC Ratio | 25-40x |

| IPO Readiness | 8.3/10 |

Market Sizing

Figure 8: $50B+ market opportunity with segment breakdown

Figure 8: $50B+ market opportunity with segment breakdown

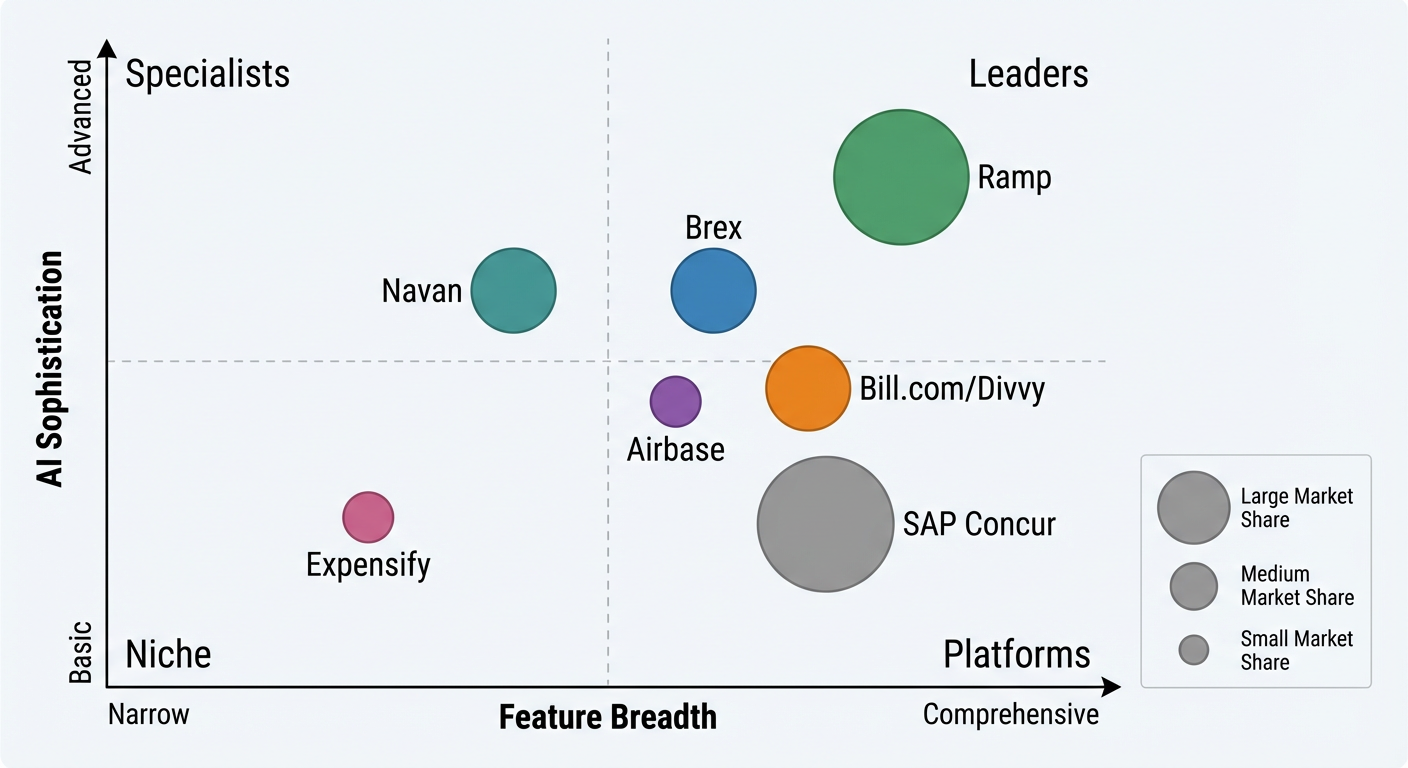

Competitive Positioning

K-Dense Web mapped the competitive landscape across feature breadth and AI sophistication:

Figure 9: Competitive positioning - Ramp leads in AI sophistication

Figure 9: Competitive positioning - Ramp leads in AI sophistication

Unit Economics Analysis

The platform dissected Ramp's revenue model and customer economics:

Figure 10: Customer LTV build-up showing exceptional unit economics

Figure 10: Customer LTV build-up showing exceptional unit economics

Key finding: 25-40x LTV/CAC ratio, among the best in enterprise SaaS.

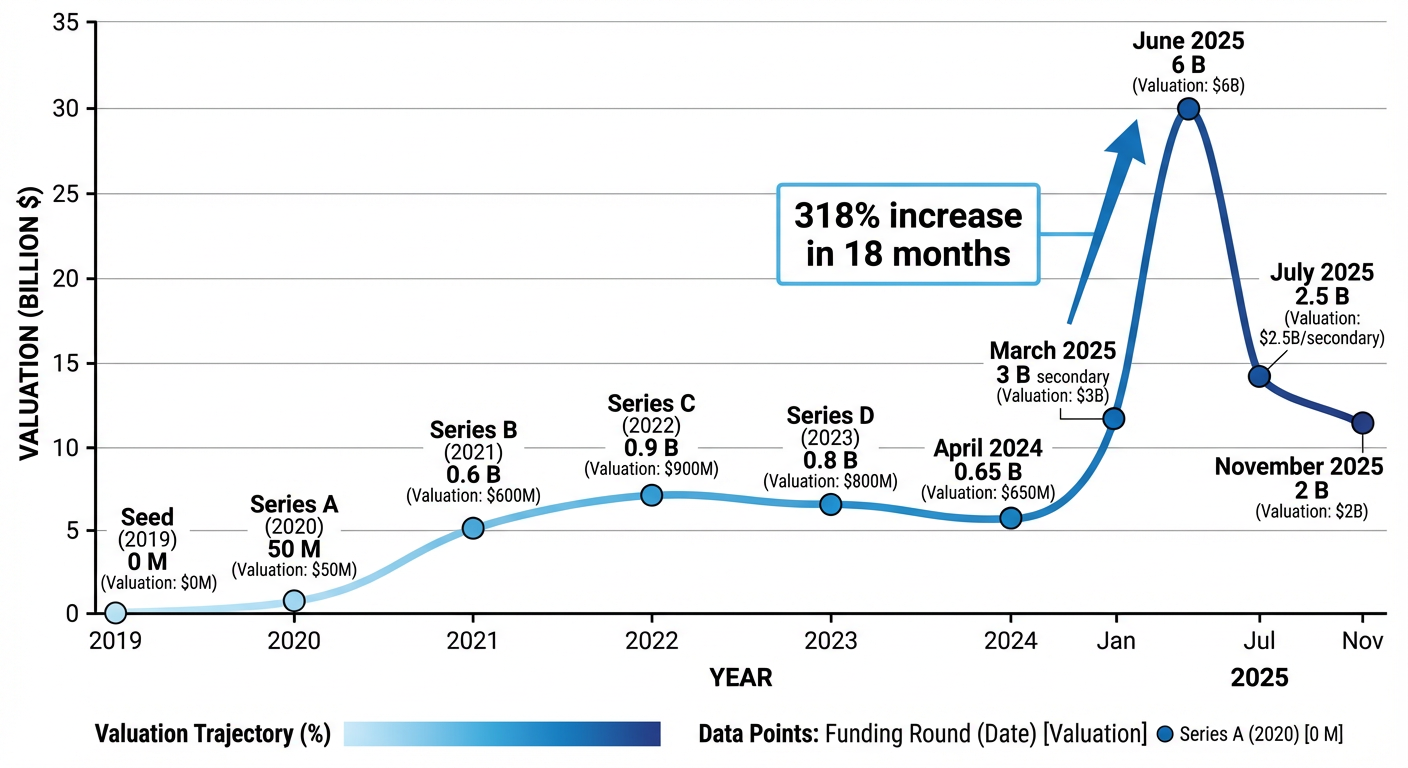

Growth Trajectory

Figure 11: Ramp customer growth showing enterprise acceleration

Figure 11: Ramp customer growth showing enterprise acceleration

Valuation Analysis

K-Dense Web modeled bull, base, and bear scenarios:

Figure 12: Funding and valuation milestones with forward projections

Figure 12: Funding and valuation milestones with forward projections

| Scenario | Valuation (2027-28) | Probability |

|---|---|---|

| Bull | $50-60B | 30% |

| Base | $28-35B | 50% |

| Bear | $12-18B | 20% |

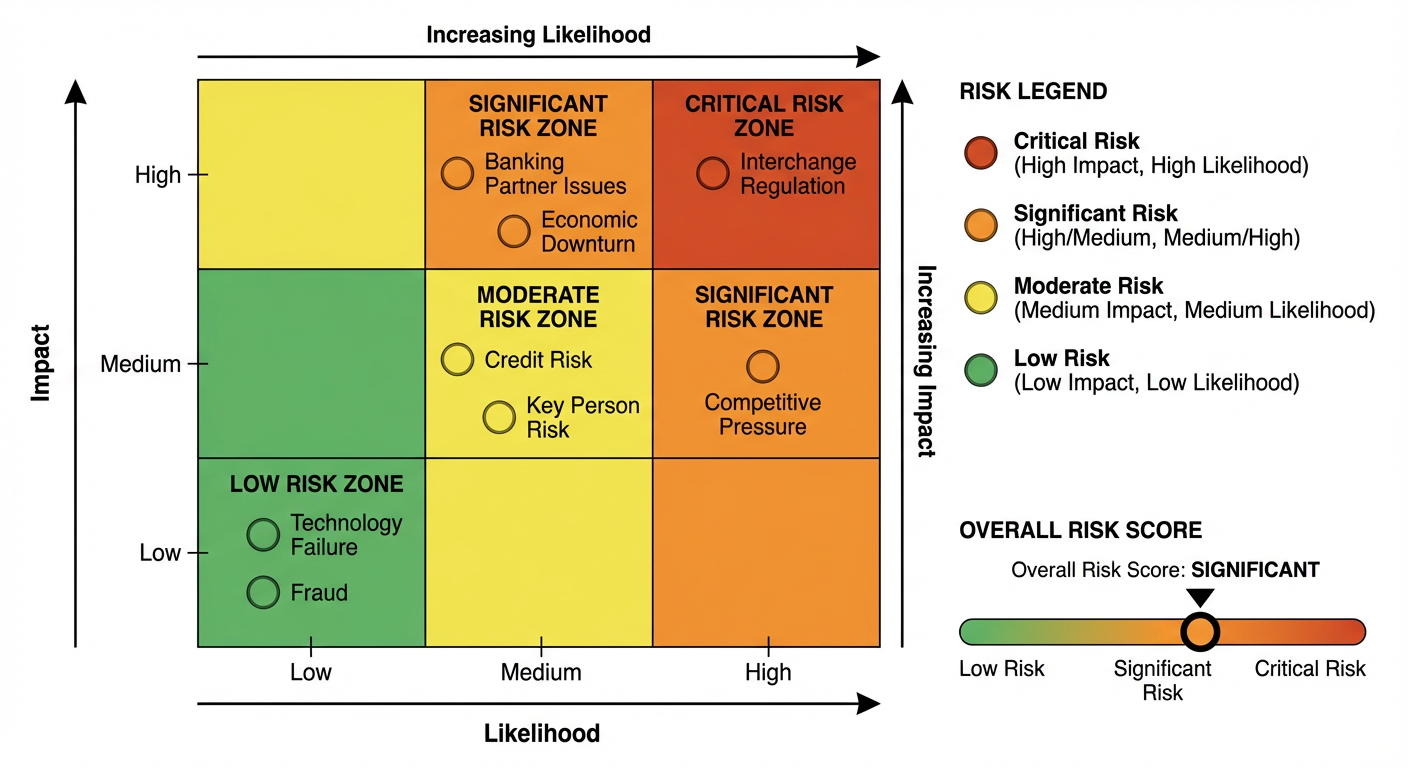

Risk Assessment

Figure 13: Ramp risk matrix - interchange regulation identified as primary risk

Figure 13: Ramp risk matrix - interchange regulation identified as primary risk

Primary risk: Interchange fee regulation could compress margins 30-40%.

Download the Full Report

Download Ramp Due Diligence Report (PDF)

What K-Dense Web Delivers for VC Due Diligence

Both case studies demonstrate K-Dense Web's core capabilities:

1. Automated Market Research

- TAM/SAM/SOM modeling with 6-year projections

- Segment breakdown and growth driver analysis

- Source aggregation from industry reports and company disclosures

2. Financial Modeling at Scale

- Unit economics analysis with sensitivity scenarios

- Revenue model decomposition

- Payback period and margin analysis

3. Competitive Intelligence

- Multi-provider benchmarking

- Feature and pricing comparisons

- Moat assessment and Porter's Five Forces

4. Quantitative Risk Assessment

- Risk matrices with probability and impact scoring

- Customer concentration analysis

- Supply chain and regulatory risk modeling

5. Publication-Ready Outputs

- Executive dashboards for IC presentations

- Investment memos with clear recommendations

- Professional visualizations throughout

6. Full Reproducibility

- All analysis scripts included

- Data sources documented

- Methodologies explained

Why VCs Choose K-Dense Web

Speed Without Sacrificing Depth

Traditional due diligence takes weeks. K-Dense Web delivers IC-ready packages in < 2 hrs.

Consistency Across Deals

Every analysis follows the same rigorous framework with no analyst variability.

Institutional-Grade Outputs

Professional reports ready for limited partner sharing, not just internal notes.

Always Up-to-Date

K-Dense Web searches current sources, ensuring analysis reflects the latest market conditions.

Get Started

Ready to transform your due diligence workflow?

New users receive $50 in free credits, enough to run comprehensive due diligence on your next deal.

Questions about K-Dense Web for investment analysis? Join our Slack community or reach out at contact@k-dense.ai.